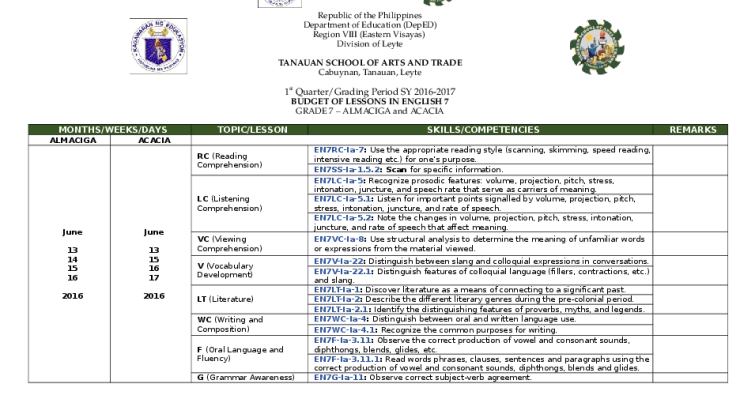

Introducing Caroline Blue’s Credit Report Worksheet, an indispensable tool that empowers individuals to take control of their financial well-being. This comprehensive worksheet provides a clear roadmap to understanding, analyzing, and improving credit scores, enabling users to unlock a brighter financial future.

Delving into the worksheet’s intricate sections, we uncover its significance in deciphering credit report data, identifying areas for improvement, and crafting personalized credit improvement plans. By harnessing the worksheet’s potential, users gain the knowledge and strategies to address negative items, build stronger credit profiles, and achieve their financial goals.

1. Introduction to Caroline Blue’s Credit Report Worksheet

Caroline Blue’s Credit Report Worksheet is a comprehensive tool designed to assist individuals in understanding and improving their credit scores. This worksheet provides a structured framework for analyzing credit reports, identifying areas for improvement, and developing personalized credit improvement plans.

Using the worksheet offers numerous benefits, including:

- Enhanced understanding of credit reports and credit scoring systems

- Identification of potential errors or inaccuracies in credit reports

- Targeted strategies for improving credit scores and building a stronger financial profile

- Improved financial literacy and decision-making

2. Understanding the Worksheet’s Components

The Caroline Blue’s Credit Report Worksheet is divided into several sections, each addressing a specific aspect of credit report analysis:

Personal Information

This section captures basic personal information, such as name, address, and Social Security number. It helps verify the identity of the individual and ensure the accuracy of the credit report.

Credit Accounts

This section lists all active and closed credit accounts, including credit cards, loans, and mortgages. It provides details such as account numbers, balances, payment history, and credit limits.

Inquiries, Caroline blue’s credit report worksheet

This section shows all inquiries made on the individual’s credit report, including both hard inquiries (made by lenders when reviewing credit applications) and soft inquiries (made by employers or insurance companies).

Public Records

This section includes any public records related to the individual, such as bankruptcies, judgments, or tax liens. These records can negatively impact credit scores.

Summary and Analysis

This section provides a summary of the individual’s credit history and score, along with an analysis of key trends and patterns. It also identifies areas for improvement and offers personalized recommendations.

3. Analyzing Credit Report Data

Analyzing the data presented in the worksheet is crucial for understanding the individual’s credit situation. Key factors to consider include:

- Payment history: On-time payments are essential for maintaining a high credit score.

- Credit utilization: Using a high percentage of available credit can negatively impact scores.

- Credit mix: Having a diverse mix of credit accounts (e.g., credit cards, loans) can improve scores.

- Credit inquiries: Excessive hard inquiries can lower scores.

- Public records: Negative public records can significantly impact scores.

By identifying areas of strength and weakness, individuals can develop targeted strategies for improving their credit scores.

4. Developing a Credit Improvement Plan

The worksheet provides a framework for developing a personalized credit improvement plan. This plan should include:

- Specific goals and timelines

- Strategies for addressing negative items (e.g., disputing errors, negotiating settlements)

- Steps to build positive credit history (e.g., making on-time payments, reducing credit utilization)

- Regular monitoring and adjustments as needed

By following a structured plan, individuals can work towards improving their credit scores and achieving their financial goals.

5. Tracking Progress and Making Adjustments: Caroline Blue’s Credit Report Worksheet

Tracking progress and making adjustments to the credit improvement plan is essential for sustained success. Regular monitoring allows individuals to:

- Assess the effectiveness of their strategies

- Identify any setbacks or areas for improvement

- Adjust the plan as needed to stay on track

The worksheet can be used as a monitoring tool, helping individuals stay organized and focused on their credit improvement goals.

Questions and Answers

What is the primary purpose of Caroline Blue’s Credit Report Worksheet?

The worksheet is designed to guide individuals in understanding their credit reports, identifying areas for improvement, and developing personalized credit improvement plans.

How can the worksheet help improve credit scores?

By analyzing credit report data and identifying negative items, users can develop targeted strategies to address these issues and gradually improve their credit scores.

Is the worksheet suitable for individuals with limited financial knowledge?

Yes, the worksheet is designed to be user-friendly and accessible to individuals of all financial backgrounds. It provides clear explanations and step-by-step guidance throughout the process.