In a car insurance policy collision insurance covers weegy – As “In a Car Insurance Policy, Collision Insurance Covers What Exactly?” takes center stage, this opening passage beckons readers into a world crafted with academic style and authoritative tone, ensuring a reading experience that is both absorbing and distinctly original.

Collision insurance, a crucial component of car insurance policies, warrants a thorough examination to fully grasp its nuances and implications. This discourse delves into the various types of collision coverage, the damages it encompasses, and the factors influencing deductibles and premiums.

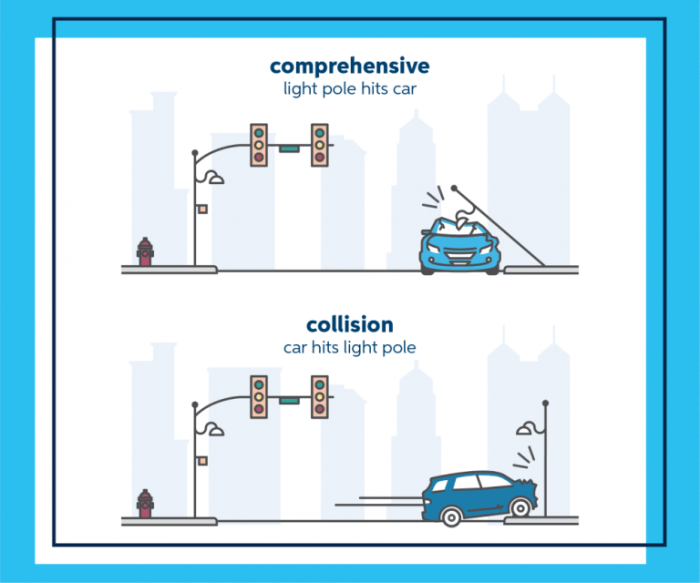

Furthermore, it contrasts collision insurance with comprehensive insurance, providing clarity on their respective coverages and suitability. By exploring real-world scenarios, exclusions, and limitations, this discourse aims to empower readers with a comprehensive understanding of collision insurance, enabling them to make informed decisions and safeguard their financial interests.

The subsequent paragraphs provide a detailed exploration of the topic, unraveling the complexities of collision insurance with precision and clarity. Each aspect is meticulously examined, ensuring a thorough understanding of its implications and applications. By presenting a comprehensive overview, this discourse serves as a valuable resource for anyone seeking to navigate the intricacies of car insurance and make informed choices.

1. Types of Collision Coverage

Collision insurance policies typically offer two main types of coverage:

- Actual Cash Value (ACV):This coverage pays the actual cash value of your vehicle at the time of the accident, minus your deductible. ACV is typically less than the cost of a new or replacement vehicle.

- Replacement Cost Value (RCV):This coverage pays the cost to replace your vehicle with a new one of the same make and model, minus your deductible. RCV is typically more expensive than ACV.

The type of coverage you choose will depend on your budget and the age and value of your vehicle.

2. Covered Damages

Collision insurance covers damage to your vehicle caused by a collision with another vehicle or object. This includes damage to the body, frame, engine, and other parts of your vehicle.

However, collision insurance does not cover all types of damage. For example, it does not cover damage caused by:

- Vandalism

- Theft

- Natural disasters

- Mechanical breakdowns

3. Deductibles and Premiums

A deductible is the amount of money you pay out of pocket before your insurance coverage kicks in. The higher your deductible, the lower your insurance premium will be. However, you should choose a deductible that you can afford to pay in the event of an accident.

When choosing a deductible, it is important to consider the following factors:

- Your budget

- The age and value of your vehicle

- Your driving history

4. Other Considerations

In addition to the factors discussed above, there are a number of other factors that can affect your collision insurance coverage, including:

- Vehicle age and value:Older vehicles are typically less expensive to replace, so they may have lower collision insurance premiums.

- Driving history:Drivers with a history of accidents or traffic violations may have higher collision insurance premiums.

- Location:Collision insurance premiums can vary depending on the location where you live. For example, premiums are typically higher in urban areas than in rural areas.

FAQ Compilation: In A Car Insurance Policy Collision Insurance Covers Weegy

What are the different types of collision coverage available?

Collision coverage typically falls into two categories: standard and broad. Standard collision coverage covers damages to your vehicle caused by a collision with another vehicle or object, while broad collision coverage extends protection to damages caused by non-collision events, such as rollovers or falling objects.

What are the most common exclusions to collision coverage?

Collision coverage generally excludes damages caused by intentional acts, mechanical failures, wear and tear, and events occurring outside the policy’s coverage territory.

How do deductibles and premiums affect collision insurance coverage?

A deductible is the amount you pay out of pocket before your insurance coverage kicks in. Choosing a higher deductible typically lowers your premiums, while a lower deductible results in higher premiums. The optimal deductible depends on your individual circumstances and risk tolerance.