The student budget answer key marcus – The Student Budget Answer Key: A Comprehensive Guide to Financial Success delves into the intricacies of budgeting for students, providing a roadmap to financial well-being and empowering them to make informed decisions about their money.

This invaluable resource offers a comprehensive understanding of the key components of a student budget, including income, expenses, and savings, and explores effective budgeting strategies and techniques that can help students prioritize expenses, cut costs, and maximize their savings.

1. Understanding the Student Budget Answer Key Marcus

The Student Budget Answer Key Marcus is a comprehensive resource designed to guide students in creating and managing effective budgets. It provides a structured approach to financial planning, helping students understand their income, expenses, and savings.

The Answer Key includes a detailed overview of the budgeting process, including sections on income tracking, expense categorization, savings strategies, and budgeting tools. It is intended for students of all ages and backgrounds, providing a valuable resource for financial literacy and well-being.

Target Audience, The student budget answer key marcus

- Undergraduate and graduate students

- Students living on or off campus

- Students with limited financial resources

- Students seeking to improve their financial management skills

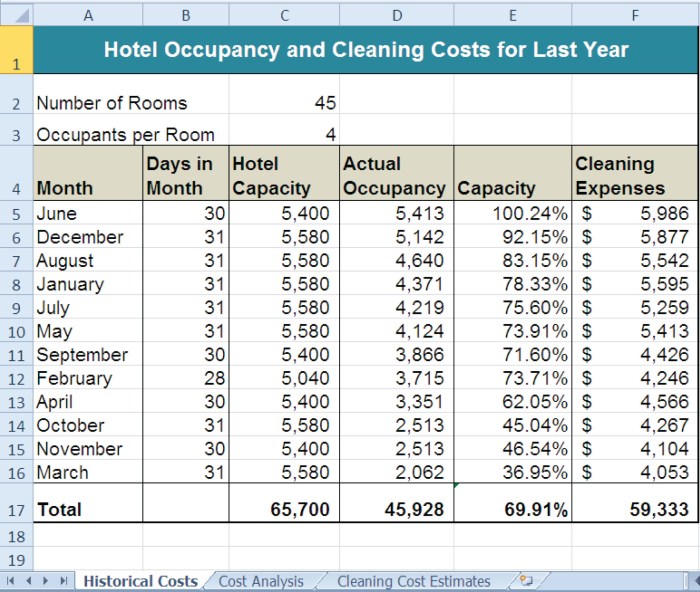

2. Analyzing the Key Components of the Budget

A student budget typically consists of three main components:

Income

Income refers to all the money a student receives, including earnings from employment, scholarships, grants, and financial aid.

Expenses

Expenses are the costs associated with living, such as tuition, housing, food, transportation, and entertainment.

Savings

Savings are the funds set aside for future expenses or emergencies. It is essential for students to prioritize saving a portion of their income to build financial security.

Common Income and Expense Categories

- Income:Wages, tips, scholarships, grants, financial aid

- Expenses:Tuition, rent, utilities, groceries, transportation, entertainment

3. Exploring Budgeting Strategies and Techniques

The Student Budget Answer Key Marcus suggests several effective budgeting strategies for students:

Using Budgeting Tools

Budgeting tools, such as spreadsheets, apps, and online platforms, can help students track their income and expenses more efficiently.

Prioritizing Expenses

Students should prioritize their expenses, focusing on essential costs such as tuition, housing, and food before allocating funds for non-essential items.

Cutting Costs

Students can explore ways to reduce their expenses, such as negotiating lower rent, using public transportation, or cooking meals at home.

Maximizing Savings

Setting aside a portion of income for savings is crucial for financial stability. Students can automate savings through automatic transfers or use dedicated savings accounts.

4. Real-World Applications and Case Studies

Numerous students have successfully used the Student Budget Answer Key Marcus to manage their finances:

Case Study: Student A

Student A was struggling to manage her student loans and living expenses. Using the Answer Key, she created a detailed budget, identified areas to cut costs, and increased her savings. Within a year, she was able to reduce her debt and build a small emergency fund.

Case Study: Student B

Student B was unsure how to allocate his scholarship funds. With the guidance of the Answer Key, he created a budget that allowed him to cover his expenses, save for future expenses, and invest in his education.

5. Additional Resources and Support

Students seeking additional financial assistance or budgeting guidance can access the following resources:

Financial Aid

Colleges and universities offer financial aid programs, such as scholarships, grants, and loans, to help students cover the costs of education.

Budgeting Workshops

Many colleges and community organizations offer budgeting workshops and counseling services to help students develop and manage their budgets.

Online Platforms

Several online platforms provide budgeting tools, financial literacy resources, and support for students.

Essential FAQs

What is the purpose of the Student Budget Answer Key?

The Student Budget Answer Key is a comprehensive guide designed to help students understand the fundamentals of budgeting, manage their finances effectively, and achieve financial success.

What are the key components of a student budget?

The key components of a student budget include income, expenses, and savings. Income refers to the money earned from various sources, expenses are the costs incurred for various needs and wants, and savings represent the portion of income set aside for future financial goals.

What are some effective budgeting strategies for students?

Effective budgeting strategies for students include creating a realistic budget, tracking expenses, prioritizing expenses, cutting costs, and maximizing savings. These strategies help students manage their finances wisely and achieve their financial goals.